The diamond industry

- See also: Diamonds as an investment

The diamond industry can be broadly separated into two basically distinct categories: one dealing with gem-grade diamonds and another for industrial-grade diamonds. While a large trade in both types of diamonds exists, the two markets act in dramatically different ways.

Gem diamond industry

A large trade in gem-grade diamonds exists. Unlike precious metals such as gold or platinum, gem diamonds do not trade as a commodity: there is a substantial mark-up in the retail sale of diamonds. Contrary to popular belief, there is a well-established market for resale of polished diamonds (e.g. pawnbroking, auctions, second-hand jewellery stores, diamantaires, bourses, etc.). One hallmark of the trade in gem-quality diamonds is its remarkable concentration: wholesale trade and diamond cutting is limited to just a few locations. 92% of diamond pieces cut in 2003 were in Surat, Gujarat, India.[27] Other important centers of diamond cutting and trading are Antwerp, where the International Gemological Institute is based, London, New York, Tel Aviv, and Amsterdam. A single company—De Beers—controls a significant proportion of the trade in diamonds. They are based in Johannesburg, South Africa and London, England. One contributory factor is the geological nature of diamond deposits: several large primary kimberlite-pipe mines each account for significant portions of market share (such as the Jwaneng mine in Botswana, which is a single large pit operated by De Beers that can produce between 12.5 to 15 million carats of diamonds per year[28]), whereas secondary alluvial diamond deposits tend to be fragmented amongst many different operators because they can be dispersed over many hundreds of square kilometres (e.g. alluvial deposits in Brazil).

The production and distribution of diamonds is largely consolidated in the hands of a few key players, and concentrated in traditional diamond trading centers. The most important being Antwerp, where 80% of all rough diamonds, 50% of all cut diamonds and more than 50% of all rough, cut and industrial diamonds combined are handled.[citation needed] This makes Antwerp the de facto 'world diamond capital'. New York, however, along with the rest of the United States, is where almost 80% of the world's diamonds are sold, including auction sales. Also, the largest and most unusually shaped rough diamonds end up in New York.[citation needed] The De Beers company, as the world's largest diamond miner holds a clearly dominant position in the industry, and has done so since soon after its founding in 1888 by the British imperialist Cecil Rhodes. De Beers owns or controls a significant portion of the world's rough diamond production facilities (mines) and distribution channels for gem-quality diamonds. The company and its subsidiaries own mines that produce some 40 percent of annual world diamond production. At one time it was thought over 80 percent of the world's rough diamonds passed through the Diamond Trading Company (DTC, a subsidiary of De Beers) in London[1], but presently the figure is estimated at around 40 percent[2]. De Beers sold off the vast majority its diamond stockpile in the late 1990s - early 2000s[3] and the remainder largely represents working stock (diamonds that are being sorted before sale)[4]. This was well-documented in the press[5] but remains little-known to the general public.

The De Beers diamond advertising campaign is acknowledged as one of the most successful and innovative campaigns in history. N. W. Ayer & Son, the advertising firm retained by De Beers in the mid-20th century, succeeded in reviving the American diamond market and opened up new markets, even in countries where no diamond tradition had existed before. N.W. Ayer's multifaceted marketing campaign included product placement, advertising the diamond itself rather than the De Beers brand, and building associations with celebrities and royalty. This coordinated campaign has lasted decades and continues today; it is perhaps best captured by the slogan "a diamond is forever".

Further down the supply chain, members of The World Federation of Diamond Bourses (WFDB) act as a medium for wholesale diamond exchange, trading both polished and rough diamonds. The WFDB consists of independent diamond bourses in major cutting centres such as Tel Aviv, Antwerp, Johannesburg and other cities across the USA, Europe and Asia.

In 2000, the WFDB and The International Diamond Manufacturers Association established the World Diamond Council to prevent the trading of diamonds used to fund war and inhumane acts.

WFDB's additional activities also include sponsoring the World Diamond Congress every two years, as well as the establishment of the International Diamond Council (IDC) to oversee diamond grading.

Industrial diamond industry

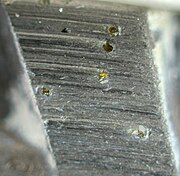

The market for industrial-grade diamonds operates much differently from its gem-grade counterpart. Industrial diamonds are valued mostly for their hardness and heat conductivity, making many of the gemological characteristics of diamonds, such as clarity and color, irrelevant for most applications. This helps explain why 80% of mined diamonds (equal to about 100 million carats or 20,000 kg annually), unsuitable for use as gemstones, are destined for industrial use. In addition to mined diamonds, synthetic diamonds found industrial applications almost immediately after their invention in the 1950s; another 3 billion carats (600 metric tons)[citation needed] of synthetic diamond is produced annually for industrial use. Approximately 90% of diamond grinding grit is currently of synthetic origin.

The dominant industrial use of diamond is in cutting, drilling, grinding, and polishing. Most uses of diamonds in these technologies do not require large diamonds; in fact, most diamonds that are gem-quality except for their small size, can find an industrial use. Diamonds are embedded in drill tips or saw blades, or ground into a powder for use in grinding and polishing applications. Specialized applications include use in laboratories as containment for high pressure experiments (see diamond anvil cell), high-performance bearings, and limited use in specialized windows.

With the continuing advances being made in the production of synthetic diamonds, future applications are beginning to become feasible. Garnering much excitement is the possible use of diamond as a semiconductor suitable to build microchips from, or the use of diamond as a heat sink in electronics.

The boundary between gem-quality diamonds and industrial diamonds is poorly-defined and partly depends on market conditions (for example, if demand for polished diamonds is high, some suitable stones will be polished into low-quality or small gemstones rather than being sold for industrial use). Within the category of industrial diamonds, there is a sub-category comprising the lowest-quality, mostly opaque stones, which are known as bort or 'boart'.

Diamond supply chain

- See also: List of diamond mines

The diamond supply chain is controlled by a limited number of powerful businesses, and is also highly concentrated in a small number of locations around the world.

Mining, sources and production

Only a very small fraction of the diamond ore consists of actual diamonds. The ore is crushed, during which care has to be taken in order to prevent larger diamonds from being destroyed, and then sorted by density. Today, diamonds are located in the diamond-rich density fraction with the help of X-ray fluorescence, after which the final sorting steps are done by hand. Before the use of X-rays became commonplace, the separation was done with grease belts; diamonds have a stronger tendency to stick to grease than the other minerals in the ore.

Historically diamonds were known to be found only in alluvial deposits in southern India.[29] India led the world in diamond production from the time of their discovery in approximately the 9th century BCE[30][25] to the mid-18th century AD, but the commercial potential of these sources had been exhausted by the late 18th century and at that time India was eclipsed by Brazil where the first non-Indian diamonds were found in 1725.[25]

Diamond production of primary deposits (kimberlites and lamproites) only started in the 1870s after the discovery of the Diamond fields in South Africa. Production has increased over time and now an accumulated total of 4.5 billion carats have been mined since that date.[31] Interestingly 20% of that amount has been mined in the last 5 years alone and during the last ten years 9 new mines have started production while 4 more are waiting to be opened soon. Most of these mines are located in Canada, Zimbabwe, Angola, and one in Russia.[31]

In the U.S., diamonds have been found in Arkansas, Colorado, and Montana.[32][33] In 2004, a startling discovery of a microscopic diamond in the U.S.[34] led to the January 2008 bulk-sampling of kimberlite pipes in a remote part of Montana.[35]

Today, most commercially viable diamond deposits are in Russia (mostly in Yakutia, for example Mir pipe and Udachnaya pipe), Botswana, Australia (Northern and Western Australia) and the Democratic Republic of Congo.[36]

In 2005, Russia produced almost one-fifth of the global diamond output, reports the British Geological Survey. Australia boasts the richest diamondiferous pipe with production reaching peak levels of 42 metric tons (41 LT; 46 ST) per year in the 1990s.[32]

There are also commercial deposits being actively mined in the Northwest Territories of Canada and Brazil. Diamond prospectors continue to search the globe for diamond-bearing kimberlite and lamproite pipes.

"Blood" diamonds

In some of the more politically unstable central African and west African countries, revolutionary groups have taken control of diamond mines, using proceeds from diamond sales to finance their operations. Diamonds sold through this process are known as conflict diamonds or blood diamonds. Major diamond trading corporations continue to fund and fuel these conflicts by doing business with armed groups. In response to public concerns that their diamond purchases were contributing to war and human rights abuses in central and western Africa, the United Nations, the diamond industry and diamond-trading nations introduced the Kimberley Process in 2002. The Kimberley Process is aimed at ensuring that conflict diamonds do not become intermixed with the diamonds not controlled by such rebel groups. This is done by requiring diamond-producing countries to provide proof that the money they make from selling the diamonds is not used to fund criminal or revolutionary activities. Although the Kimberley Process has been moderately successful in limiting the number of conflict diamonds entering the market, some still find their way in. About 2–3% of all diamonds traded today are potentially conflict diamonds[37]). According to the 2006 book The Heartless Stone, two major flaws still hinder the effectiveness of the Kimberley Process: (1) the relative ease of smuggling diamonds across African borders, and (2) the violent nature of diamond mining in nations that are not in a technical state of war and whose diamonds are therefore considered "clean."[38]

The Canadian Government has set up a body known as Canadian Diamond Code of Conduct[39] to help authenticate Canadian diamonds. This is a very stringent tracking system of diamonds and helps protect the 'conflict free' label of Canadian diamonds.

Distribution

The Diamond Trading Company (DTC) is a subsidiary of De Beers and markets rough diamonds from De Beers-operated mines (it withdrew from purchasing diamonds on the open market in 1999 and ceased purchasing Russian diamonds mined by Russian company Alrosa, at the end of 2008 and, although Alrosa has successfully appealed against a European court ruling[6], according to a statement by an Alrosa spokesperson, sales do not appear to have resumed[7]).

Once purchased by Sightholders (which is a trademark term referring to the companies that have a three-year supply contract with DTC), diamonds are cut and polished in preparation for sale as gemstones. The cutting and polishing of rough diamonds is a specialized skill that is concentrated in a limited number of locations worldwide. Traditional diamond cutting centers are Antwerp, Amsterdam, Johannesburg, New York, and Tel Aviv. Recently, diamond cutting centers have been established in China, India, Thailand, Namibia and Botswana. Cutting centers with lower cost of labor, notably Surat in Gujarat, India, handle a larger number of smaller carat diamonds, while smaller quantities of larger or more valuable diamonds are more likely to be handled in Europe or North America. The recent expansion of this industry in India, employing low cost labor, has allowed smaller diamonds to be prepared as gems in greater quantities than was previously economically feasible.

Diamonds which have been prepared as gemstones are sold on diamond exchanges called bourses. There are 26 registered diamond bourses in the world.[40] Bourses are the final tightly controlled step in the diamond supply chain; wholesalers and even retailers are able to buy relatively small lots of diamonds at the bourses, after which they are prepared for final sale to the consumer. Diamonds can be sold already set in jewelry, or sold unset ("loose"). According to the Rio Tinto Group, in 2002 the diamonds produced and released to the market were valued at US$9 billion as rough diamonds, US$14 billion after being cut and polished, US$28 billion in wholesale diamond jewelry, and US$57 billion in retail sales.

0 comments:

Post a Comment